At 9:15 a.m. Mumbai time, Nov. 6, 2015, a single document changed billions in market value. By the closing bell, Dr. Reddy’s had shed roughly fifteen percent after a U.S. FDA warning letter flagged quality-control lapses at three sites. The selloff didn’t take weeks. It took hours.

What used to be a slow, legalistic process—inspectors visit, companies respond, agencies deliberate—has turned into an information shock that financial markets price almost instantly. Warning letter, import alert, OAI classification: each phrase now has an implied basis-point cost. On the regulatory side, it’s CGMP. On the trading side, it’s P&L.

The hourglass flips faster now

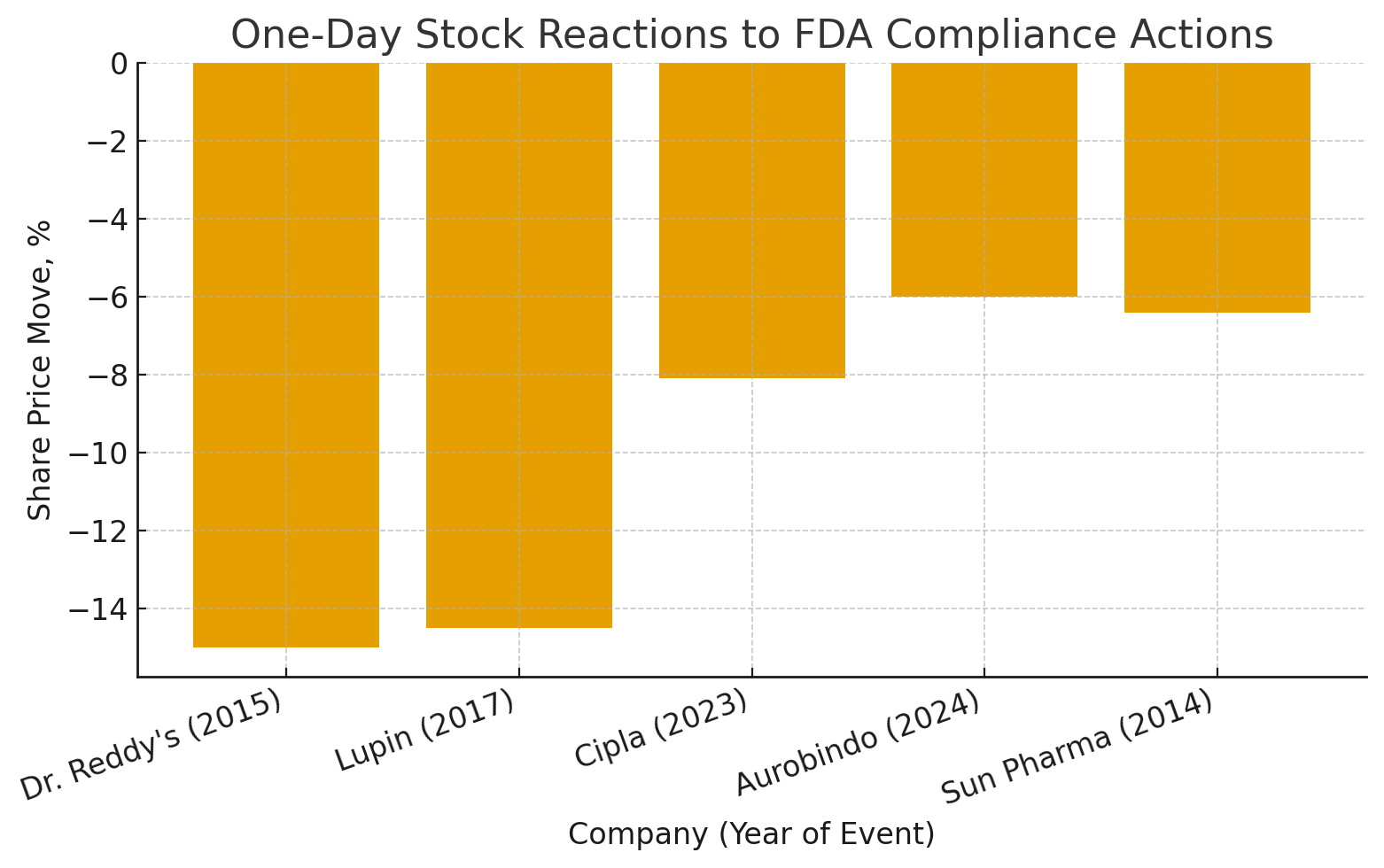

Look at the tape:

On Nov 8, 2017, Lupin (NSE: LUPIN) disclosed a US FDA Warning Letter covering the Goa and Indore plants. The shares fell about −14.5% intraday to ₹884. Management said existing supplies could continue, but fresh approvals would be delayed. The FDA letter (dated Nov 6, 2017) cites CGMP and data-integrity deficiencies at both sites. (Business Standard; FDA)

On Nov 23, 2023, Cipla (NSE: CIPLA) logged its largest one-day fall of 2023, −8.1% to ₹1,168.60, after a Warning Letter tied to Pithampur. The Sensex finished roughly flat that session, making most of the move an abnormal return rather than market beta. (Business Today)

On Aug 16, 2024, Aurobindo (NSE: AUROPHARMA) dropped as much as −6.39% intraday after its Eugia unit received a Warning Letter following an OAI (Official Action Indicated) status. With the Sensex around +0.5%, the tape again reflected an idiosyncratic regulatory discount. Management emphasized that existing supplies were unaffected, yet the market still priced approval delays and supply rerouting. (Business Standard)

Earlier, on Mar 13, 2014, Sun Pharma (NSE: SUNPHARMA) was hit with an FDA import alert on the Karkhadi, Gujarat facility—a step more severe than a Warning Letter—and the stock fell up to −6.4% intraday as the alert posted on the FDA site. (Reuters)

What the model should capture: disclosure → headlines → algorithms → discretionary selling. By midday, the compliance discount is typically visible in price. For a clean read, separate the severity of actions (483 < Warning Letter < OAI < Import Alert) and measure abnormal return versus the benchmark—that’s the cash translation of a regulatory shock.

Practical note for decks: for each event, track intraday low vs close (vol-adjusted), abnormal return vs Nifty/Sensex on the event day (clear in the Cipla and Aurobindo cases), and t+5 CAR, which often captures the “second wave” after initial headlines and early sell-side notes.

Compliance arbitrage is real—because the data is public

If you know where to look, you’re rarely surprised. The FDA posts warning letters and inspection outcomes in near-real time; dedicated pages for specific companies (Sun/Ranbaxy, for example) map a decade of actions and follow-ups. It’s a compliance blotter hiding in plain sight, and traders watch it like hawks.

When letters cite “severe data integrity deficiencies” (as they did at Intas in 2023), the market doesn’t wait for a courtroom climax—it prices the operational reality: remediation costs will rise, approvals may slow, supply could shift, and customers will ask uncomfortable questions. Even if the company is private (Intas is), listed peers and partners can still catch the shrapnel.

If you’re sensing a new micro-genre—compliance arbitrage—you’re right. It’s not insider trading. It’s public-source sprinting: parsing Form 483s, OAI classifications, and warning letter language for signals about near-term volumes and mid-term margins. Sun’s long saga around Halol shows how quickly “observations” morph into price pressure once investors suspect an OAI trajectory.

What, exactly, is the market pricing in?

Not moral outrage. Cash flows.

A warning letter today says two things out loud and three things between the lines. Out loud: “Quality system gaps exist” and “FDA expects fixes.” Between the lines: (1) approvals might be delayed, (2) remediation will cost real money, and (3) counterparties—buyers and partners—will quietly diversify. In Lupin’s case, the company itself told investors to expect delays in fresh U.S. approvals, and you could see the multiple compress on the news.

Investors roll those priors forward because history rhymes. Ranbaxy’s legacy and Sun’s import alerts taught the street that “data integrity” is never just a paperwork sin; it’s a production and reputational drag that takes multiple quarters to unwind. The FDA’s own Ranbaxy/Sun enforcement log reads like a cautionary cash-flow narrative in bullet points.

The number you can point to

To make this painfully tangible, here’s a simple one-day snapshot—the “first-day price tag” the market slapped on recent compliance hits:

Dr. Reddy’s (2015) ≈ −15% (warning letter)

Reuters

Lupin (2017) ≈ −14.5% intraday (warning letter)

Business Standard

Cipla (2023) ≈ −8.1% (warning letter)

Business Today

Aurobindo (2024) ≈ −6% (warning letter)

Business Standard

Sun Pharma (2014) ≈ −6.4% (import alert)

Reuters

That’s day one. The longer-dated bill includes consulting armies, validation re-runs, yield hits, inventory write-downs, and a subtle tax on trust.

Anatomy of a selloff

It starts quietly—in the plant, in the lab, or in QA. Then someone writes something down, or fails to. Inspectors arrive. A Form 483 records observations. The company drafts a response. If the gaps are systemic or the response thin, a warning letter lands. Traders don’t need to see the whole script anymore; the first act is enough.

From there, markets behave like a risk-adjusted spreadsheet. U.S. sales exposure sets the amplitude. Product mix sets the duration. If a site feeds close-to-market launches, the penalty goes up; if it’s a secondary supplier, the street is kinder. If prior letters already exist, investors assume a longer remediation runway. In other words: compliance becomes a variable in the model, not a footnote in the 10-K.

Why companies still get blindsided

Because they treat compliance as a factory-floor problem when it’s actually a capital-markets problem. When FDA language escalates from “observation” to “adulterated” and “data integrity,” investors hear “earnings risk” and “optionality lost.” The market applies a forward discount the moment it believes future free cash flows will slip—even if production today is “unaffected.” Aurobindo’s cautionary line—“no impact on existing supplies”—didn’t stop a brisk, same-day drawdown.

The solution isn’t spin; it’s speed and specificity. If your warning letter implies delays in approvals, say so and quantify. If remediation spans quarters, give a schedule that customers can plan around. If data integrity touched release testing, acknowledge the scope and the independent oversight you’ve retained. Investors punish ambiguity more than they punish bad news with a credible fix.

The new play on the street

Let’s be honest: markets have professionalized the monitoring of quality events. There are desks that scrape the FDA warning-letter feed; research shops that keep living maps of OAI facilities; funds that build statistical priors on first-day and one-week abnormal returns for specific issuers. This isn’t gambling. It’s supply-chain macro expressed through single names.

And there’s a public-health upside to this ruthless pricing. When “quality” is free, it is fragile. When quality failures carry an immediate market cost, boards feel it. It sharpens incentives to invest in systems, not slogans.

What to do next—if you are…

- A manufacturer with live U.S. exposure: run a joint drill between QA and IR right now. If you got a 483 yesterday, behave as if a warning letter could post tomorrow. Draft the market-facing plan the same day you draft the CAPA. Remember how Sun’s issues metastasized across cycles; regulators and investors are patient until they are not.

- A buyer in the supply chain: don’t wait for a letter to become a shortage. Watch the same pages traders watch. If a key API site trends toward OAI, line up alternates before everyone else does. Price is not just demand and feedstock anymore; price is the cost of trust underwritten by documentation.

- An investor: accept that compliance is a factor. Treat warning-letter exposure like litigation exposure—rare, non-linear, and devastating when clustered. Use the tape to separate noise from signal: big drop with thin evidence? Maybe a trade. Clear data-integrity language tied to critical sites? That’s a thesis.

Why it matters

Because this is more than optics. In a world of thin generics margins and globally stretched supply, a few PDF pages on the FDA site can shift a quarter’s earnings, reroute procurement, change API prices, and—let’s say it—affect patient access. That’s the true price tag of data integrity: not only the engineers you’ll hire and the batches you’ll throw away, but the permanent tax markets will levy on your credibility until you earn it back. And that tax, now, is measured in hours.

Open the full market picture for your next decision →